This article must be read if you are planning to buy a house. Taxes are an important aspect when it comes to buying or selling property in India. One such tax that is applicable on the sale of immovable property like land and buildings is the Tax Deducted at Source (TDS) under Section 194-IA. The buyer is responsible for deducting the tax before making payment to the seller while purchasing the property. Let us delve deeper into the details of what TDS on sale of property under Section 194IA is, who is responsible for deducting it, and how to file it.

Union Budget 2022 updates

New Section 194S- A person is liable for Tax Deduction at Source (TDS) at 1% at the time of payment of the transfer of virtual digital assets.

How to file TDS on the Sale of Property – Sale of immovable property under Section 194-IA- It is proposed to amend the amount on which TDS should be deducted. The person buying the property should deduct tax at 1% on the sum paid/credited or the stamp duty value of such property, whichever is higher.

Requirements of section 194IA

When a buyer buys immovable property (i.e. a building or part of a building or any land other than agricultural land) costing more than Rs 50 lakhs, he has to deduct tax at source (TDS) when he pays the seller. This has been laid out in Section 194-IA of the Income Tax Act since 1st June 2013.

- The buyer has to deduct TDS at 1% of the total sale amount. Please note, the buyer is required to deduct TDS, not the seller

- TDS is required to be deducted only if total sale price is Rs 50 lakh or more

- If the payment is made by instalments, then TDS has to be deducted on each instalment paid.

- ‘Consideration for immovable’ property shall include all charges like nature of club membership fee, car parking fee, electricity or water facility fee, maintenance fee, advance fee or any other charges of similar nature, which are incidental to the transfer of the immovable property. This is applicable for immovable property purchased on or after 1 September 2019 as per Budget 2019.

- TDS is to be paid on the entire sale amount.

Example for TDS on Sale of Property, if you have bought a house at Rs 55lakh, you have to pay TDS on Rs 55 lakh and not on Rs 5 lakh (i.e. Rs 55 lakh – Rs 50 lakh). This is applicable even when there is more than 1 buyer or seller. Post the budget 2019 amendment to section 194-IA, in the above example, if on 1 September 2019, you have paid Rs 2 lakh towards parking fee, Rs 1 lakh for water facility fee and Rs 1 lakh for electricity fee, your sale consideration would be Rs 59 lakh (55+2+1+1). You will have to pay TDS on Rs 59 lakh @ 1%. Your TDS payable would be Rs 59,000.

- Buyer of the property need not obtain a TAN (Tax Deduction Account Number) for depositing TDS with the government. You can make the payment using your PAN.

- For the purpose of depositing TDS, buyer will have to obtain the PAN of the seller, else TDS must be deducted at 20%.

- TDS is deducted at the time of payment (including instalment payments) to the seller.

- The TDS on the immovable property has to be paid using Form 26QB within 30 days from the end of the month in which TDS was deducted.

- After depositing TDS to the government, the buyer is required to furnish the TDS certificate in form 16B to the seller. This is available around 10-15 days after depositing the TDS. The buyer is required to obtain Form 16B and issues the form to the seller. You can check the procedure to generate and download Form16B from TRACES here.

Steps to pay TDS through challan 26QB and to obtain Form 16

The steps to pay TDS through challan 26QB and to obtain Form 16B (for the seller) are as follows:

e-Payment through Challan 26QB (Online)

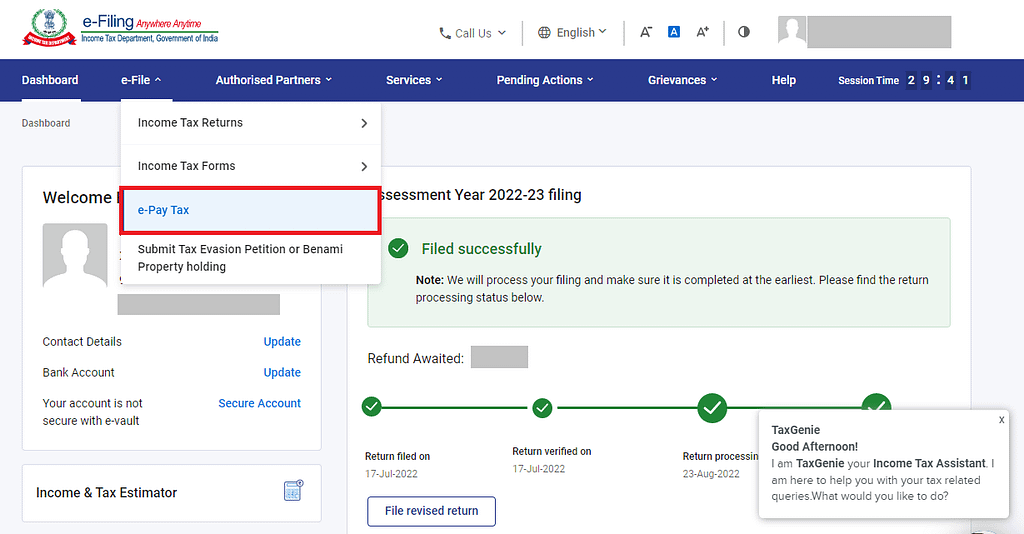

Step-1: Log in to your account on the Income Tax e-filing portal. Select e-File > click on e-Pay Tax from the dropdown as shown below

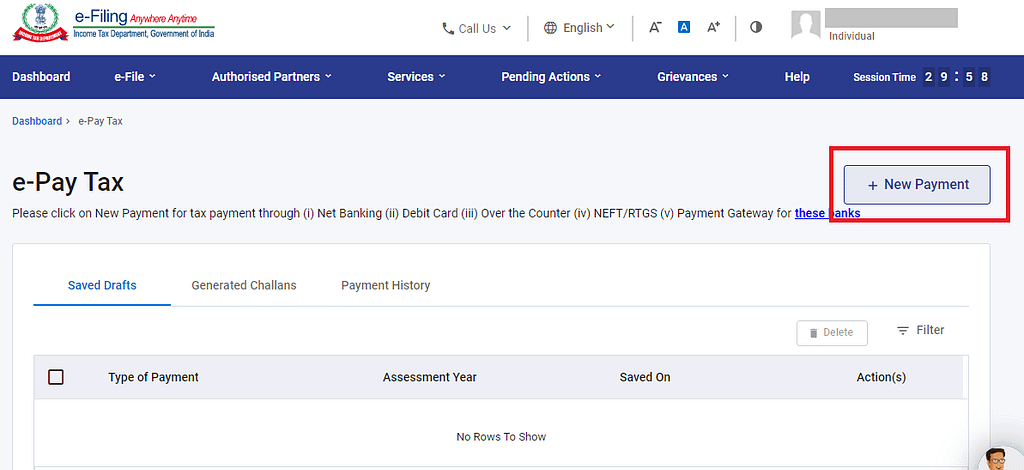

Step-2: Click on ‘+ New Payment

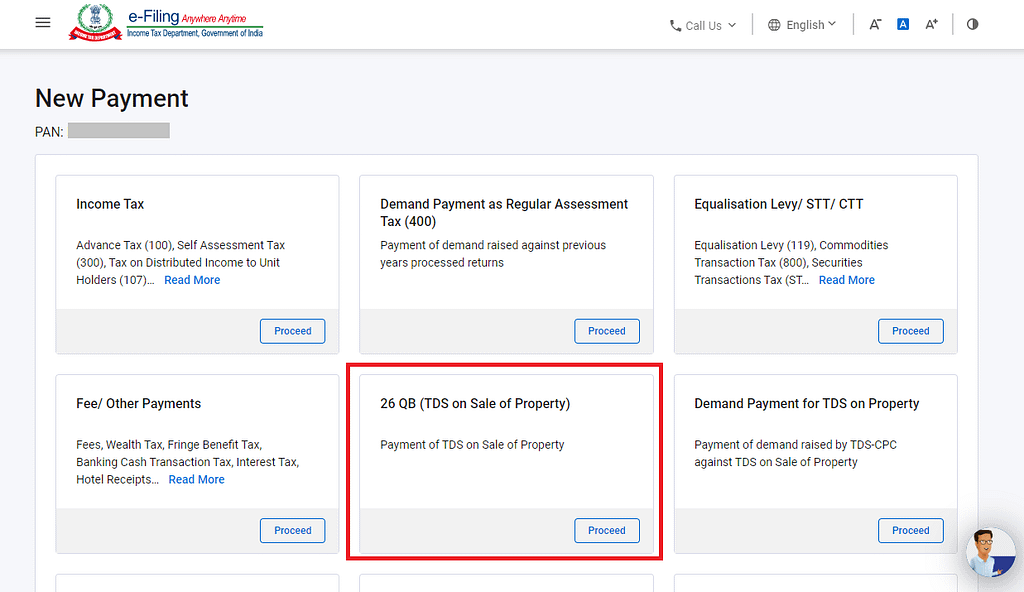

Step-3: Click on the proceed button on the tab ‘26QB- TDS on Property’ as highlighted below

Note: In the next few steps, you will have to add the following details:

- Add Buyer’s Details

- Add Seller’s Details

- Add Property Transferred Details

- Add Payment Details

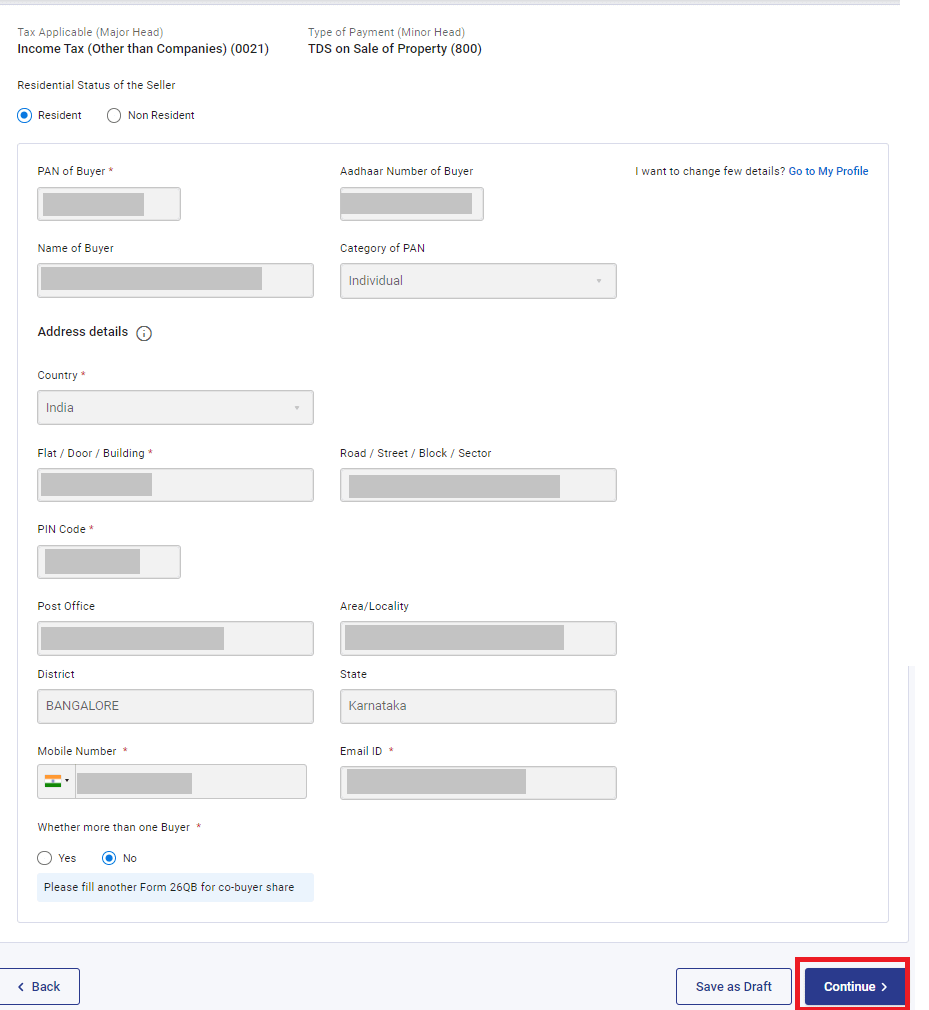

Step-4: Add Buyer’s Details

All your details will be auto-filled, but you can also change them if needed. After entering the details, click on ‘Continue’

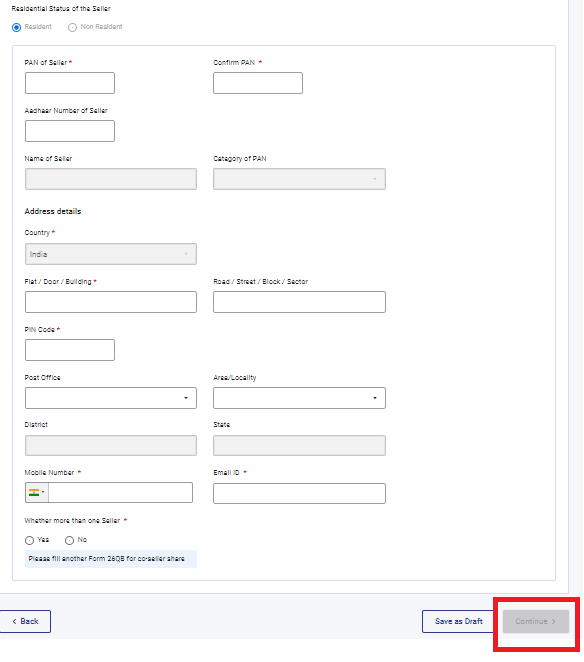

Step 5: Add Seller’s Details

Add all the details of the Seller like their PAN, address

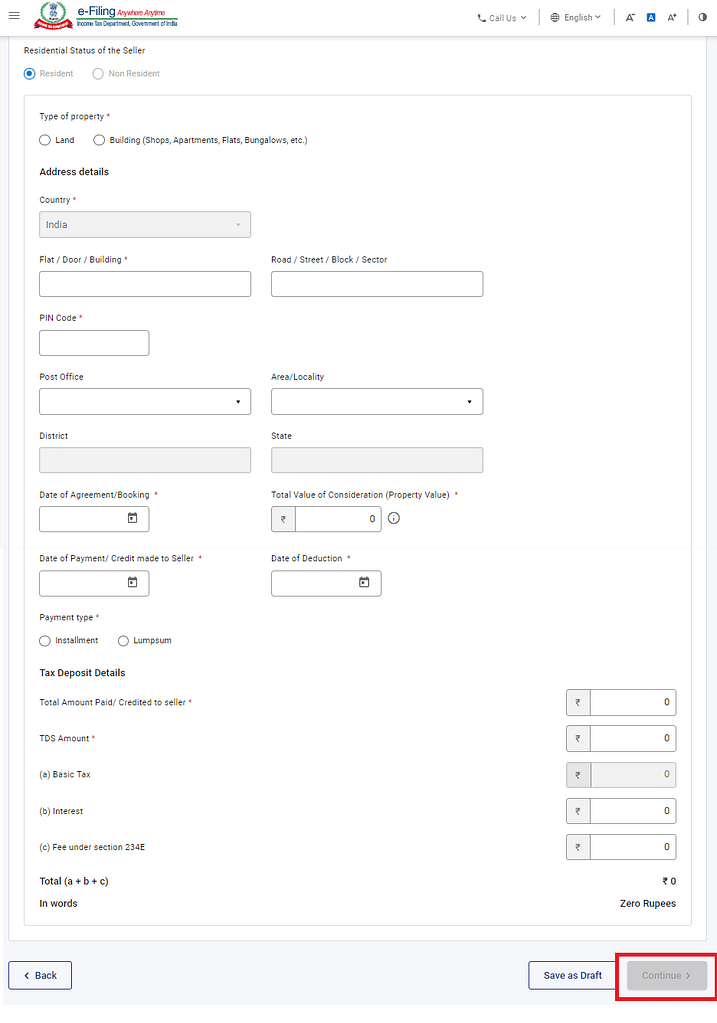

Step 6: Add Property Details

Add all the property details like type, address and also the sale details like date of agreement, value etc. The tax amount will be calculated automatically. Once done, click on ‘continue’

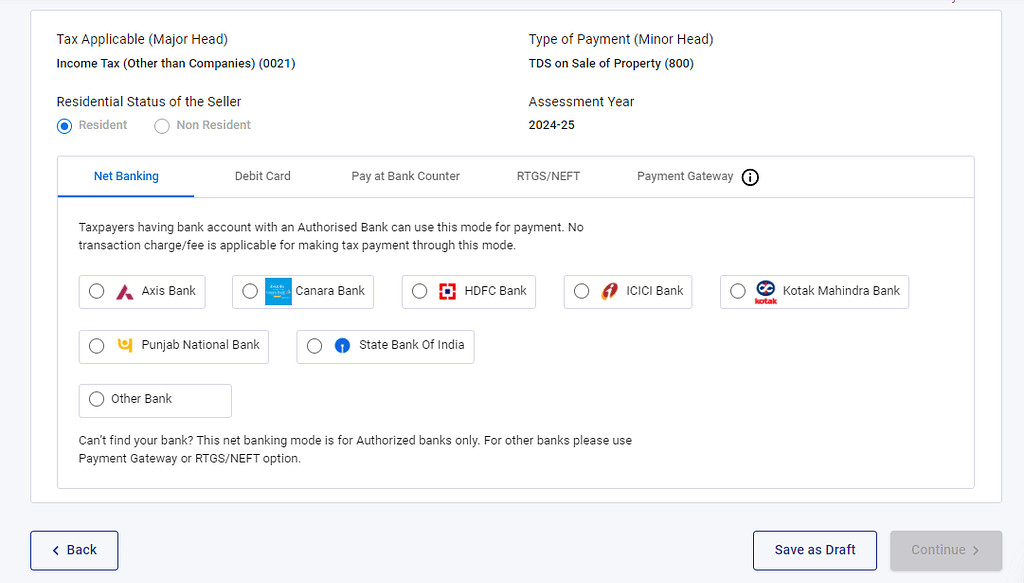

Step 7: Add Payment Details

Select the payment mode and proceed to complete the payment. Once the payment is done, a challan will be generated.

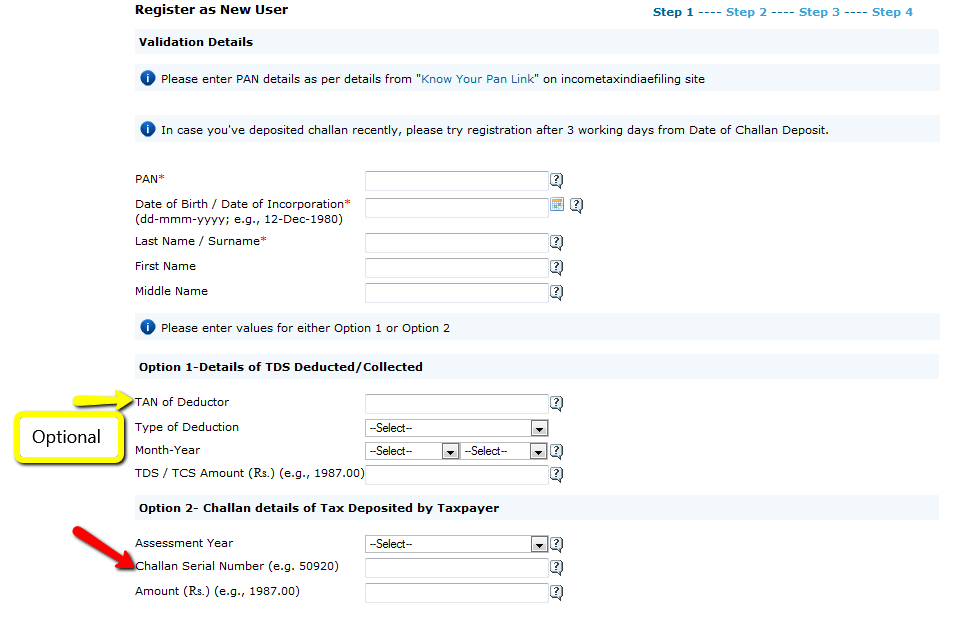

Step 8: Register in TRACES

- If you are a first-time user, register on TRACES as a Tax Payer with your PAN Card Number and the Challan number registered during payment.

- Once you register, you will be able to obtain approved Form 16B (TDS certificate) and you can issue this Form to the Seller.

- Check your Form 26AS seven days after payment. You will see that your payment is reflected under “Details of Tax Deducted at Source on Sale of Immovable Property u/s 194(IA) [For Buyer of Property]”.

- Part F gives you details such as TDS certificate number (which TRACES generates), name and PAN of deductee, transaction date and amount, acknowledgement number (which is the same as the one on your Form 26QB), date of deposit and TDS deposited.

Step 9:

Download your Form 16B

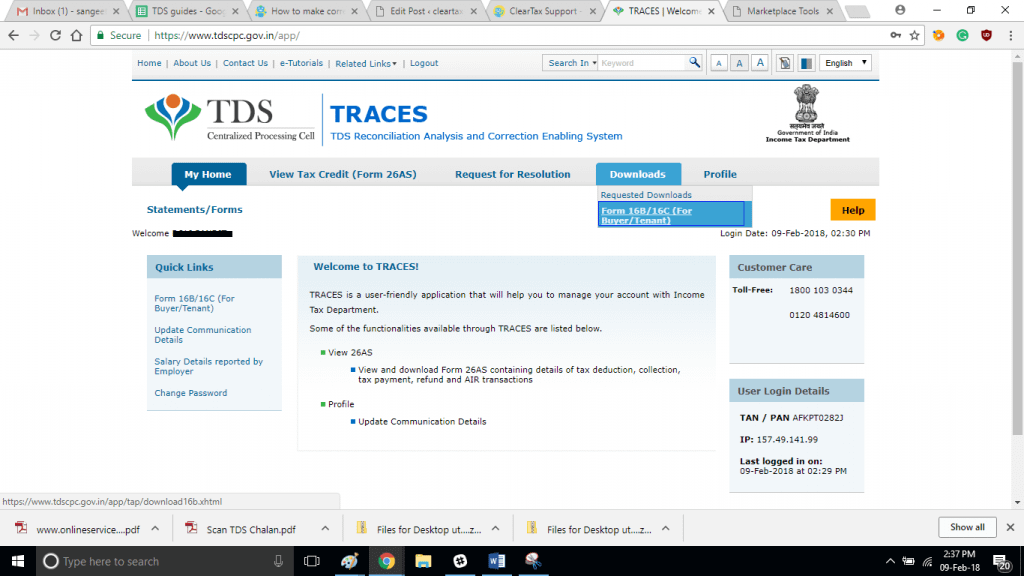

- After your payment in Form 26AS has been reflected, log in to TRACES. Go to the Download tab at the tab and click on “Form-16B (for the buyer)”.

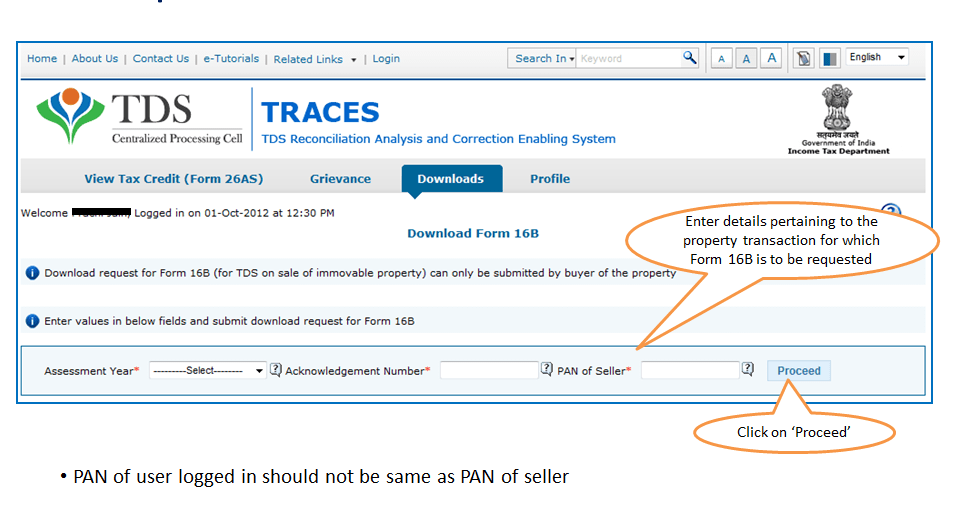

To finish this process, fill PAN of the seller and acknowledgement number details pertaining to the property transaction and click on “Proceed”.

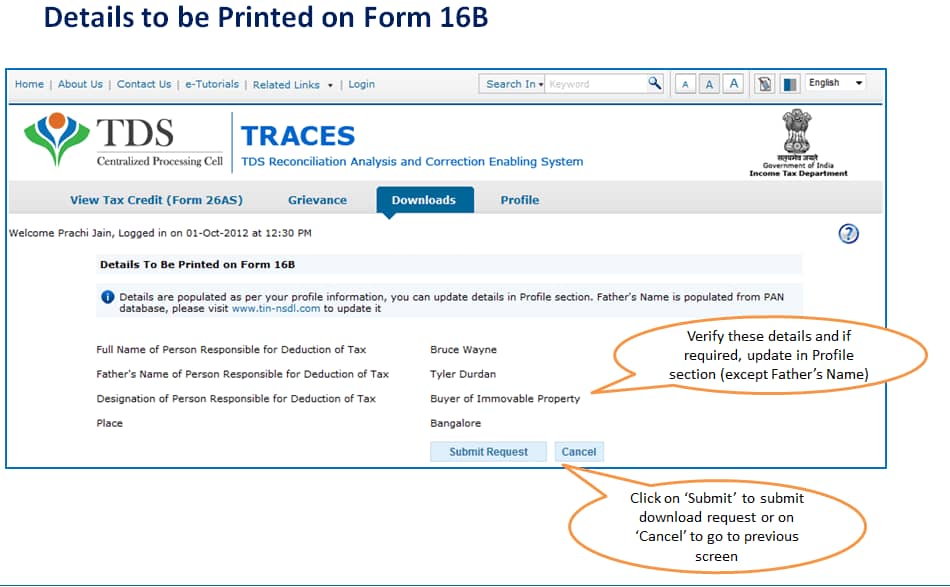

Verify all the details once and click on “Submit a request”.

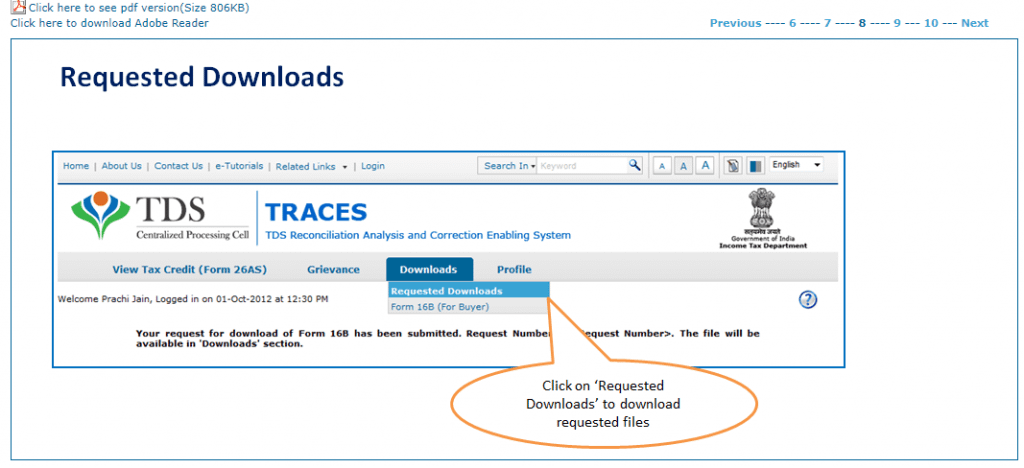

After a few hours, your request will be processed. Click on the Downloads tab and select Requested Downloads from the drop-down menu

- You should be able to see that the status of your Form 16B download request is ‘available‘.

- If the status says ‘submitted‘ wait for a few hours more before repeating the last step.

- Download the ‘.zip file’. The password to open the ‘.zip file’ is the date of birth of the deductor (the format is DDMMYYYY). Your form will be available inside the .zip file as a pdf. Print this out.